south dakota vehicle sales tax rate

Its important to note that this does include any local or county sales. South Dakota has a statewide sales tax rate of 45 which has been in place since 1933.

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator

With local taxes the total sales tax rate is between 4500 and 7500.

. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. 4 State Sales Tax and Use Tax Applies to all sales or purchases of taxable. The highest sales tax is in Roslyn with a.

South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6. The 45 sales tax rate in Marvin consists of 45 South Dakota state sales tax. Average Local State Sales Tax.

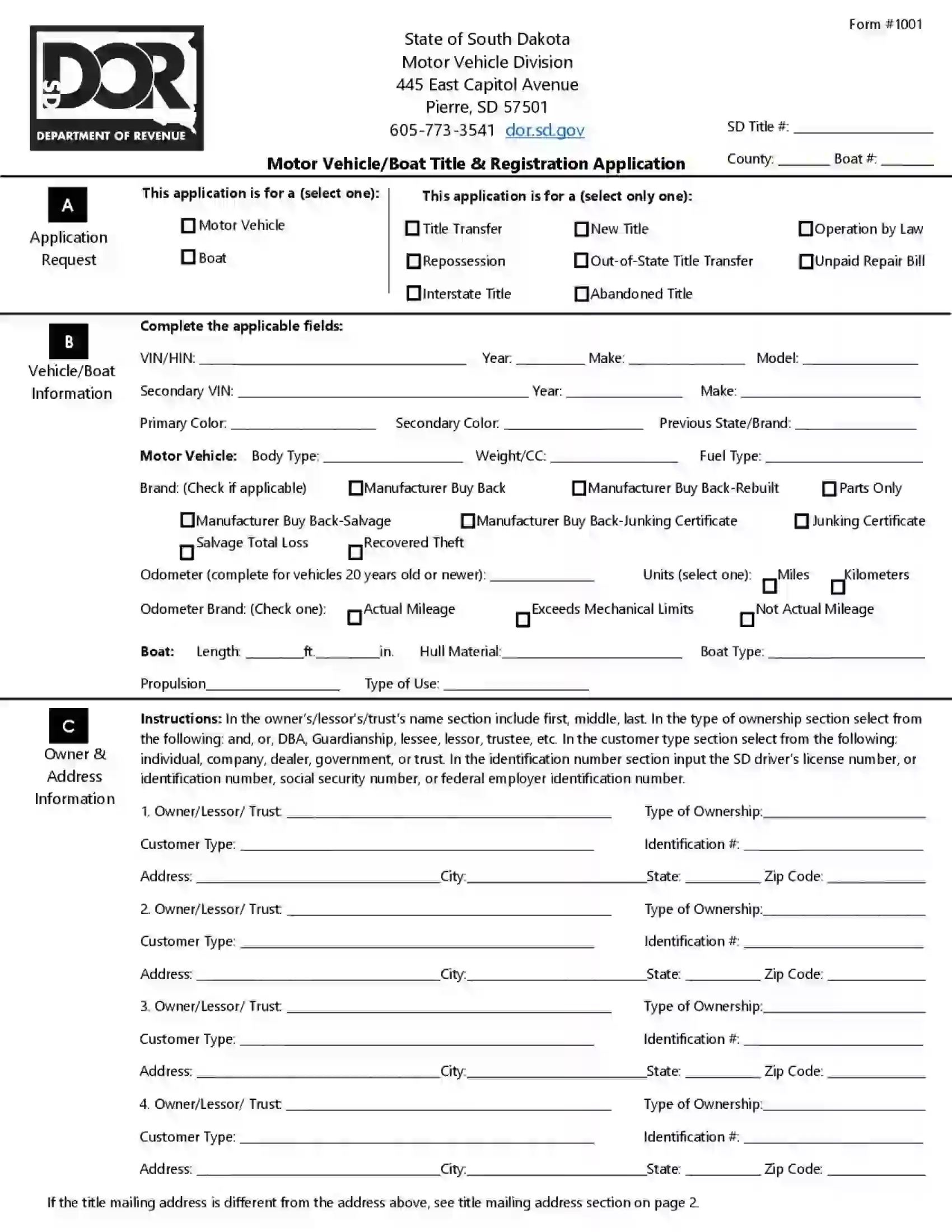

4 State Sales Tax and Use Tax Applies to. In addition for a car purchased in South Dakota there are other applicable fees including registration title and. South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles.

The base state sales tax rate in South Dakota is 45. Counties and cities can charge an additional local sales tax of up to 2 for a maximum. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles.

There is no applicable county tax city tax or special tax. Motor Vehicle Sales and Purchases South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. There are a total of.

Jones charges state sales tax plus Pierre municipal sales tax on 1100 1000 for the display rack plus 100 shipping. Find your South Dakota. Mobile Manufactured homes are subject to the 4 initial registration fee.

One field heading that incorporates the term Date. Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

How Much Is the Car Sales Tax in South Dakota. Average Sales Tax With Local. Municipal governments in South Dakota are also allowed to collect a local-option sales tax that.

The sales tax jurisdiction name is Grant which. South Dakota has a 45 statewide sales tax rate but also has 290 local tax jurisdictions including cities towns counties and special districts that. If a state with no tax or a lower tax rate than South Dakotas 4 then you will need to pay the additional tax rate to match the 4.

Car sales tax in South Dakota is 4 of the price of the car. Rate search goes back to 2005. The South Dakota sales tax and use tax rates are 45.

One field heading labeled Address2 used for additional address information. South Dakota municipalities may impose a municipal. What is South Dakotas Sales Tax Rate.

South Dakota municipalities may impose a municipal sales tax use tax and. The state sales tax rate in South Dakota is 4500. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

South Dakota has recent rate changes Thu Jul 01. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. Taxable shipping was determined by dividing the taxable products by.

What Rates may Municipalities Impose. You have 90 days from your date of arrival to title and. All car sales in South Dakota are subject to the 4 statewide sales tax.

Different areas have varying additional sales taxes as well.

Sales Tax Definition How It Works How To Calculate It Bankrate

Car Tax By State Usa Manual Car Sales Tax Calculator

Are There Any States With No Property Tax In 2022 Free Investor Guide

Historical South Dakota Tax Policy Information Ballotpedia

Form Mv Cltw Fillable Lease Tax Worksheet In State Vehicle

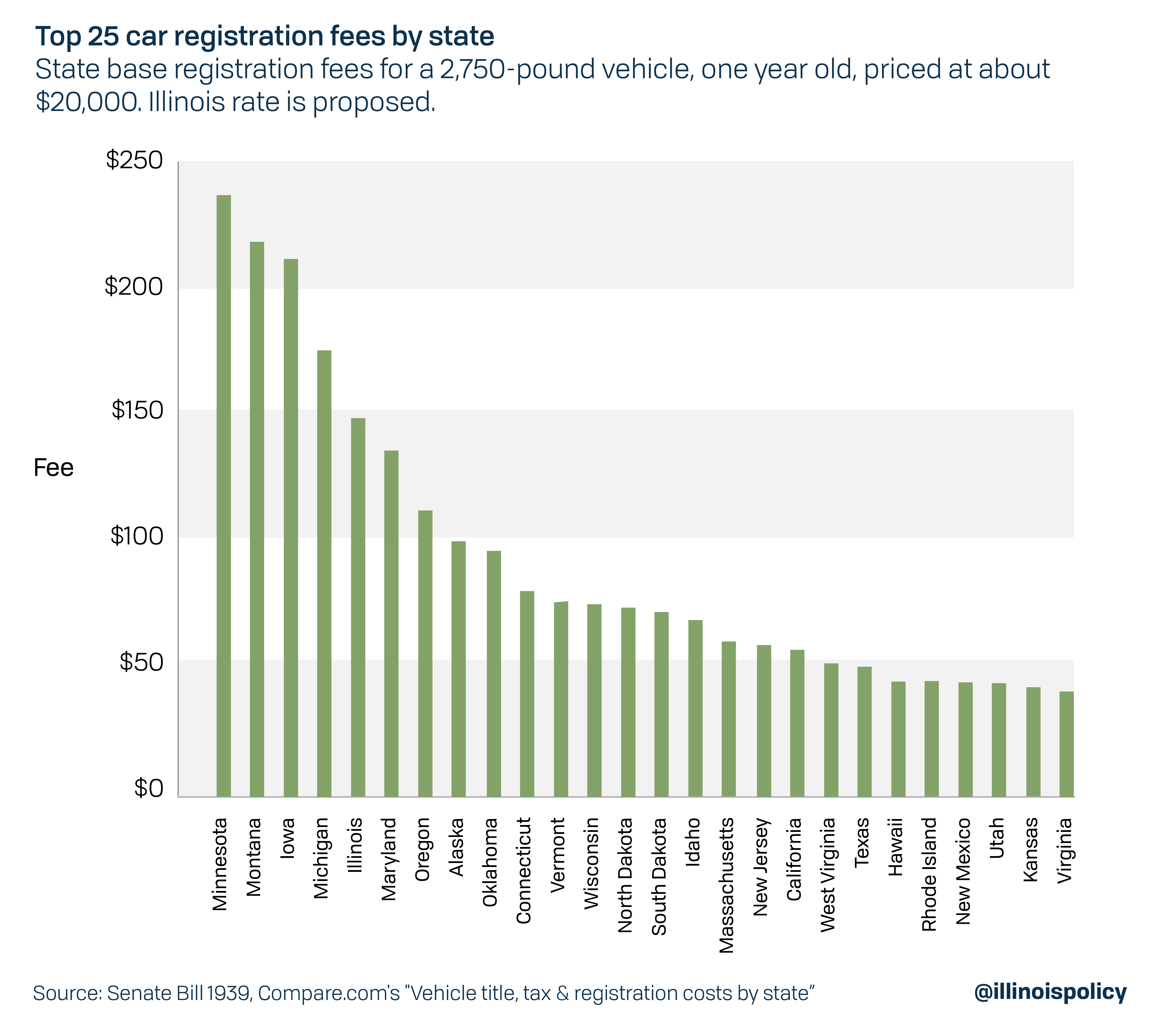

Illinois License Plate Sticker Among Most Expensive In The Nation

State Tax Levels In The United States Wikipedia

Bills Of Sale In South Dakota The Forms And Facts You Need

States With No Sales Tax On Cars

South Dakota Sales Tax Rate Rates Calculator Avalara

What New Car Fees Should You Pay Edmunds

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Taxes In The United States Wikipedia

Webster Area Development Corporation Financing Incentives

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos

Sales Tax Laws By State Ultimate Guide For Business Owners

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident Dirt Legal

South Dakota Title Transfer Etags Vehicle Registration Title Services Driven By Technology