oregon statewide transit tax rate

Statewide Transit tax STT rate is. Signature Date Phone Title X.

What Is The Oregon Transit Tax How To File More

Oregon employers must withhold 01 0001 from each employees gross pay.

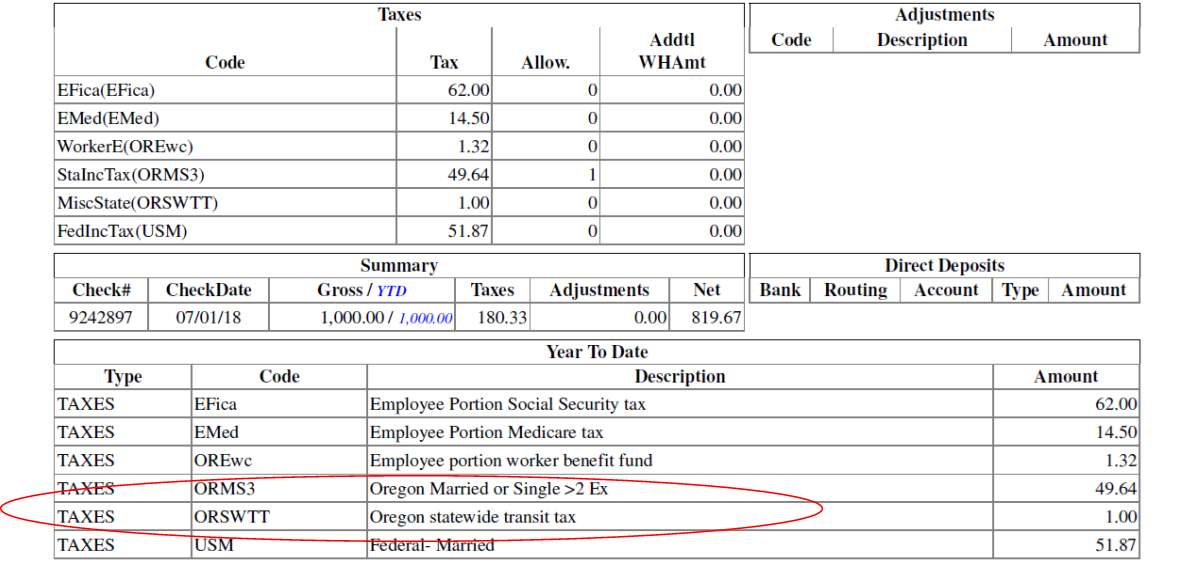

. Reporting System OPRS beginning with the third quarter filing of 2022. Statewide Transit Tax Statewide Transit Tax Statewide Transit Tax Starting July 1 2018 youll see a new item on your paystub for Oregons statewide transit tax. The 2017 Oregon Legislature passed House Bill HB 2017 which included the new statewide transit tax.

If the result is off youll need to make a liability adjustment to correct your tax payments. Return and payment are due by April 30 2022. If an employee is an Oregon resident but your business isnt in Oregon you can.

01 Date received. Statewide Transit Tax will be included with Frances in the first quarter of. This tax will be strictly enforced and employers could face penalties if they do not withhold this tax in a timely manner.

The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. If an employee is an Oregon resident but your business isnt. OREGON STATEWIDE TRANSIT TAX.

Heres how it should look like. Department regulations require employers to report the Oregon statewide transit tax in Box 14 of Form W-2 with the designation ORSTT WH for example ORSTT WH - 1500. Frances OEDs new modern system.

Two Oregon local transit payroll taxes administered by the state are to have their rates increase for 2022 the state revenue department said. Tax deductions are available for some adaptive equipment. The tax is not related to the local TriMet transit payroll tax see below for info on local Oregon transit taxes.

Oregon Transit Payroll Taxes for Employers A guide to TriMet and Lane Transit Payroll taxes 150-211-503 Transit self-employment taxes 150-500-406 Author. Parts of HB 2017 related to the statewide transit tax were amended in the 2018 session. Wages of Oregon residents regardless of where the work is performed.

The Ohio state sales tax rate is 575 and the average OH sales tax after local surtaxes is 71. Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev. Ad Fill Sign Email OR OR-STT-1 Form More Fillable Forms Register and Subscribe Now.

Click the Formula button and then enter the. Your average tax rate is 328 and your marginal tax rate is 443. Employers are also required to withhold the Oregon statewide transit tax of 01 from the wages of 1 Oregon residents regardless of where the work is performed and 2 nonresidents who perform services in Oregon.

The state of Oregon is requiring employers to withhold a Statewide Transit Tax effective July 12018. Transit taxes are reported quarterly using the Oregon Quarterly Tax Report and tax payments are made using the payment coupon Form OR-OTC-V or through the. The tax rate is 010 percent.

In September 2022 OEDs new modernized system. The transit tax will include the following. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages.

01 Date received Payment received Submit original formdo not submit photocopy Place a -0- in the subject wages box if the employer is subject to the tax but there was not payroll this quarter. STATEWIDE TRANSIT TAX EMPLOYEE WAGE TAX - ORTRN The Oregon statewide transit tax rate remains at 01 in 2022. On July 1 2018 employers must start withholding the tax one-tenth of 1 percent or 001 from.

STI tax is calculated on wages earned by an employee who is an Oregon resident regardless of where the work is performed or an employee who is a nonresident who performs services in Oregon. News Pacific NW Oregon closing in on vaccination goal and reopening economy. Withhold the Oregon transit tax from Oregon residents as well as nonresidents who perform services in Oregon.

Your employer will be automatically withholding the taxjust like the personal income taxso you dont have to do or change anything. Oregon withholding tax formulas. Statewide Transit tax STT rate is.

The tax is one-tenth of one percent 0001 or 1 per 1000 of wages. Oregon employers must withhold 01 0001 from each employees gross pay. Wages of nonresidents who perform services in Oregon.

The tax item simply does not appear in the tax table area under each employee. The state transit tax is withheld on employee wages via tax code ORTRN. This tax must be withheld on.

The Tri-County Metropolitan Transportation District Tri-Met tax rate is to increase to 07937 from 07837 and the Lane County Mass Transit District LTD tax rate is to increase to 077 from 076 the department. On July 1 2018 employers began withholding the tax one-tenth of 1 percent or 001 from. The statewide transit individual STI tax helps fund public transportation services within Oregon.

Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev. There is no maximum wage base. 2 wages paid to nonresidents of Oregon while they are working in Oregon.

A Statewide transit tax is being implemented for the State of Oregon. The tax rate is 010. Weve applied the payroll updates again just in case and the item.

Named Frances will replace the Oregon Payroll. Once done you can verify rate used for the deduction and review the total Statewide Transit Tax for that employee. January 1 2022March 31 2022.

If your income is over 0 but not over 7300 your tax is 475 of the Oregon taxable income. This tax is NOT related to the Lane or TriMet transit payroll taxes it is in addition to all other local tax codes for. 1 wages paid to residents of Oregon regardless where they work.

The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. Withhold the state transit tax from Oregon residents and nonresidents who perform services in Oregon. Check the box for the quarter in which the statewide transit tax was withheld.

Employees become subject to this new tax on July 1 2018. The Oregon legislature recently passed House Bill HB 2017 which creates a new statewide transit tax on Oregon residents and nonresidents working in Oregon to fund state highway upgrades. TriMet Transit District rate 1114 to 123115 0007237 1116 to 123116 0007337 1117 to 123117 0007437.

For some reason the Oregon Statewide Transit Tax item is not being made available for any of the the new employees that were entered into Quickbooks in December of 2018. Oregon withholding tax tables. Lane Transit District LTD tax rate is 00077.

The tax is one-tenth of one percent 001or 1 per 1000. If your income is over 7300 but not over 18400 your tax is 347 65 of the excess of 7300. And 3 periodic pension payments.

About the statewide transit tax. To get the correct amount just multiply the Wage Base by the 01 tax rate.

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Oregon Transit Tax Procare Support

Oregon Transit Tax Procare Support

Oregon Transit Tax Procare Support

Ezpaycheck How To Handle Oregon Statewide Transit Tax

New Transit Tax Cardinal Services

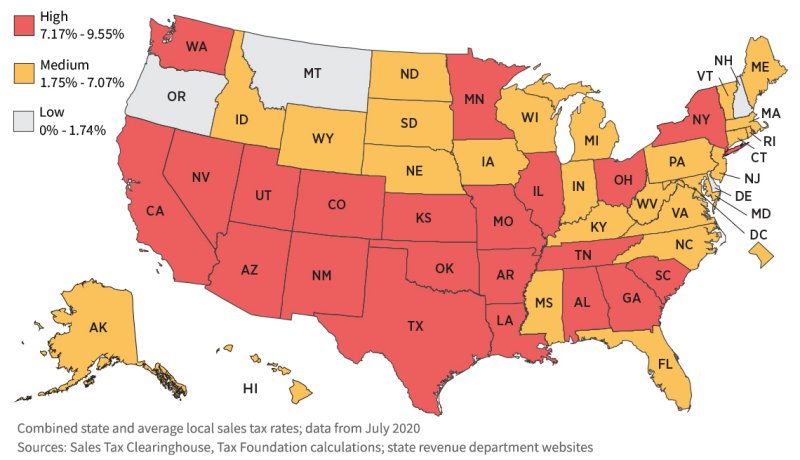

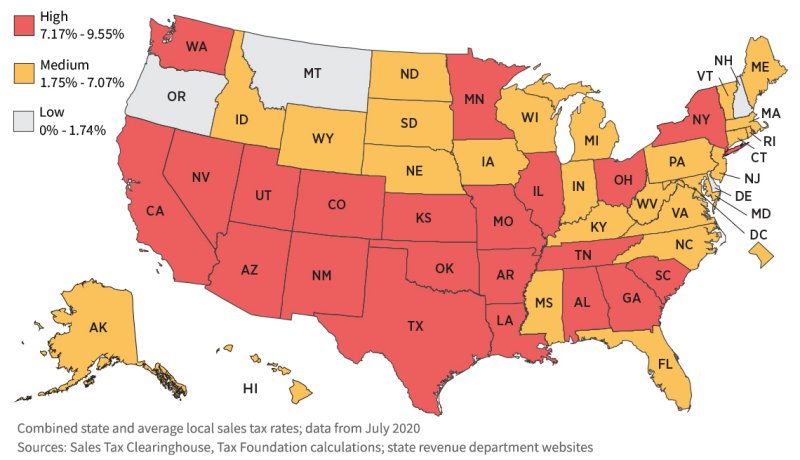

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With Highest And Lowest Sales Tax Rates

Ezpaycheck How To Handle Oregon Statewide Transit Tax